Investment Criteria

Partnering with Market-Leading Companies.

Investment Criteria

Partnering with Market-Leading Companies.

IGP Investment Criteria

Business Types

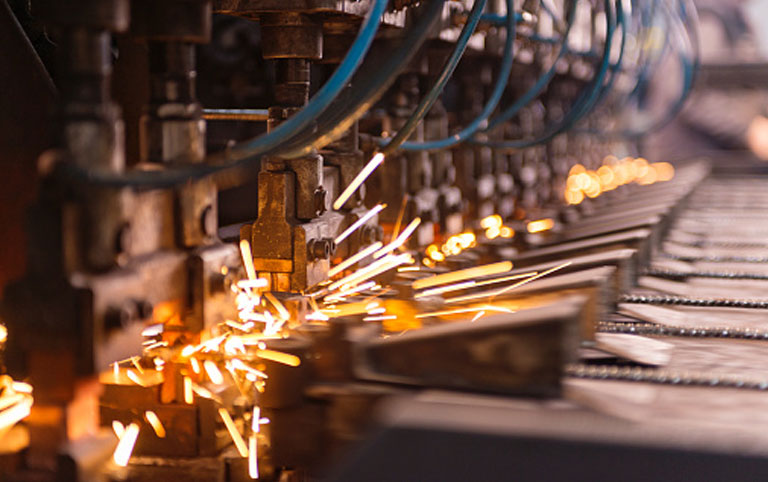

Niche manufacturers, value-added distributors and critical industrial services businesses

View Portfolio >Size

Revenue up to $250 million (although add-ons can be smaller) with a history of profitability

Geography

Platforms headquartered in the U.S. or Canada (no geographic limits on add-ons)

Preferred Industry Sectors

Analytical Instruments and Measuring Devices

Critical Industrial Services

Electrical and Electronic Equipment

Engineered Materials

Fluid Control, Filtration and Pumps

Industrial Components and Equipment

Infrastructure and Power Products

Medical and Safety Equipment

Process Instrumentation and Controls

Transaction Types

Entrepreneur/Family-Owned Recapitalization — A significant number of private businesses have reached a transition stage where the founder and the next generation owners/management have different goals and objectives. These founders often prefer to work with a private equity firm like IGP that has significant experience working through the transition from family ownership. A recapitalization is often appealing to business owners because they can monetize part of their ownership position, while at the same time retain a significant, continuing interest in the business. Whether it is a recapitalization or outright sale, many owners take significant comfort from IGP’s long-term approach to building businesses.

Corporate Divestitures — IGP has significant experience investing in corporate divestitures from large companies when a division is deemed non-strategic or non-core. IGP partners with the management teams of these non-core divisions to set them on new growth trajectories by establishing clear management incentives and by providing access to capital, operating and strategic resources.

Private Equity-Owned Companies — As the number of private equity firms has proliferated, many middle market manufacturing companies have received investments from institutional capital providers. These companies have reached the end of the investment horizon for their current investors, yet there are still many strategic growth initiatives to be tapped with a subsequent private equity investor. IGP has extensive experience guiding businesses through these transitions. We believe we are a proven and trusted option, for both the investors looking to exit as well as the management teams seeking another partner to help them achieve their longer-term strategic objectives.

Co-Operative Divestitures — Larger companies often develop proprietary products or processes that are non-core to their primary operations, but which divisional management believes have excellent prospects for future growth. In these situations it is often in a parent company’s best interests to partner with an outside investor to help exploit the opportunity, while retaining some upside alongside a capable and trusted private equity firm. In these instances, management of the division would partner with IGP to acquire a majority stake in the division, with the corporate parent retaining a meaningful minority ownership position.

To discuss investment opportunities, please contact Rob Austin at 415.882.4550 x313